SOL Price Prediction: Will the Oversold Asset Break $200?

#SOL

- Technical Bottom Forming: Oversold RSI and MACD divergence suggest weakening downward momentum

- Ecosystem Momentum: PumpSwap's $100M TVL and Robinhood's expansion signal adoption growth

- Critical Threshold: $160 support holding is prerequisite for any sustained rally

SOL Price Prediction

SOL Technical Analysis: Oversold Conditions May Precede Rebound

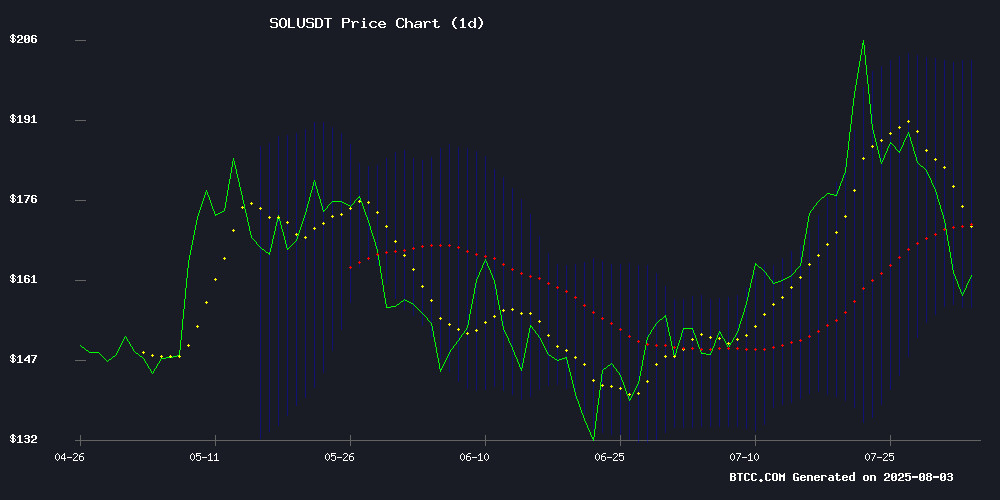

SOL is currently trading at $161.19, significantly below its 20-day moving average of $179. The MACD histogram shows bullish divergence at -2.77 (signal line at -10.32), while Bollinger Bands indicate potential support at $155.96.says BTCC analyst James.

Mixed Signals for Solana Amid Market Turbulence

While solana tests crucial support at $160, ecosystem developments show divergence. Doodles' token slump contrasts with PumpSwap's $100M TVL milestone and bullish price targets.notes BTCC's James.Robinhood's planned tokenized stocks may bring additional liquidity.

Factors Influencing SOL’s Price

Solana Tests Key Support at $160 as Technical Indicators Signal Oversold Conditions

Solana's SOL token fell 2.6% to $160.48 amid bearish technical momentum, testing lower Bollinger Band support. The decline comes without fundamental catalysts, leaving price action driven purely by chart patterns and indicator signals.

Technical readings present conflicting signals. The RSI at 41 flirts with oversold territory, suggesting potential for reversal, while the MACD's -4.2095 histogram shows strengthening downward pressure. Traders appear focused on these mechanical factors rather than ecosystem developments.

Market observers note the absence of fresh positive triggers has allowed technical selling to dominate. The MACD line's position at 0.7131, significantly below the signal line at 4.9227, paints a concerning short-term picture despite oversold conditions that could precede a bounce.

Doodles' DOOD Token Plummets Post-Launch Amid Market Frenzy

The much-anticipated launch of Doodles' DOOD token on Solana has turned into a cautionary tale. Despite intense hype and a successful airdrop, the token's market capitalization plunged 40% within 24 hours, with associated NFTs losing 60% of their value.

Market analysts point to three key factors: unclear token utility, the controversial choice of Solana blockchain, and immediate selling pressure from airdrop recipients. The project's ambitious attempt to pivot its community model appears to have backfired spectacularly.

This episode underscores the volatile nature of cryptocurrency launches, where even well-funded projects with established communities can face rapid reversals. The Solana ecosystem, while growing, continues to demonstrate particular susceptibility to such boom-bust cycles.

Solana's Bullish Momentum Meets Yeti Ouro's DeFi Ambition

Solana (SOL) exhibits robust bullish signals as institutional interest surges, with hedge funds and derivatives desks noting its rapid volume spikes and on-chain accumulation. Technical analysis suggests a potential rise to $170-$180, bolstered by China's $138 billion stimulus and favorable FOMC conditions.

Meanwhile, Yeti Ouro's Stage-4 presale has eclipsed $4 million in funding, drawing attention with its transparent tokenomics and long-term value roadmap. The altcoin projects staggering 10,000% returns, positioning itself as a disruptive force in decentralized finance.

PumpSwap Surpasses $100M in TVL Amid Memecoin Trading Resurgence

PumpSwap, the decentralized exchange launched by Solana-based memecoin platform Pump.fun, has eclipsed $100 million in total value locked (TVL) just 50 days after its March 19 debut. The milestone defies earlier predictions of a memecoin sector collapse, signaling renewed retail interest in speculative assets.

Trading activity shows no signs of slowing, with cumulative volume surpassing $18 billion. Daily transactions consistently exceed $500 million in May, peaking at nearly 500,000 active wallets on May 5 according to Dune Analytics. The platform serves as the primary liquidity venue for tokens graduating from Pump.fun's launchpad.

The TVL achievement mirrors broader memecoin market revitalization, particularly on Solana where speculative trading activity has rebounded sharply after Q1 declines. PumpSwap's growth trajectory suggests sustained demand for high-risk crypto assets despite macroeconomic uncertainties.

Memecoin Platform Boop.fun Advocates for Token 'Cults' Amid Market Saturation

Boop.fun, a nascent token launch platform, is encouraging users to form dedicated communities—or 'cults'—around their tokens. The strategy, while provocative, underscores the increasingly crowded memecoin landscape where differentiation is paramount. The platform mirrors Pump.fun's mechanics, requiring tokens to 'graduate' before rewards are distributed, with Solana and Raydium serving as foundational infrastructure.

Boop.fun's native token, BOOP, incentivizes participation: staking 100 BOOP grants 60% of trading fees from graduated tokens and a 5% airdrop of each token's supply. The approach blurs the line between community-building and market manipulation, reflecting the speculative fervor dominating niche crypto sectors.

Cambrian: Build Solana Restaking Protocols With AVS in Minutes, Not Months

The Solana ecosystem is witnessing a transformative phase as restaking protocols convert idle assets into active infrastructure. Cambrian's emergence marks a pivotal shift, enabling networks to extend beyond conventional blockchain operations by integrating off-chain computational power with on-chain security.

Actively Validated Services (AVS) and Node Consensus Networks (NCN) now facilitate advanced applications, from AI processing to privacy-centric transactions. Historically, developing such systems demanded specialized expertise akin to constructing a mini-blockchain. Cambrian streamlines this process, reducing months of intricate engineering to mere minutes.

Top 10 PumpSwap APIs Every Solana Developer Should Know in 2025

The Solana ecosystem continues to accelerate its dominance in decentralized finance, with community-driven tokens gaining unprecedented traction. Platforms like Pumpfun have democratized meme coin creation, while Pumpswap has emerged as the go-to decentralized exchange for trading these assets.

Developers now rely on specialized APIs to track real-time swaps, price movements, and liquidity metrics. These tools are becoming indispensable for building responsive trading bots, analytics dashboards, and DeFi applications that can keep pace with Solana's blistering transaction speeds.

The API ecosystem surrounding Pumpswap reflects Solana's broader maturation—what began as experimental infrastructure is now professional-grade tooling. As liquidity migrates from centralized exchanges to DEXs, these data pipelines are becoming the nervous system of Solana's trading landscape.

Robinhood Plans Tokenized US Stocks for EU Traders via Blockchain

Robinhood is advancing its crypto ambitions with a new EU platform that will tokenize US-listed securities. The initiative aims to provide European investors with 24/7 access to American equities through blockchain-based assets, potentially leveraging Solana or Arbitrum for settlement.

The move follows Robinhood's strong Q2 earnings and regulatory progress in Europe. By tokenizing traditional securities, the platform could bridge the gap between conventional markets and decentralized finance, offering improved liquidity and accessibility.

Solana's high throughput makes it a leading contender for the infrastructure, signaling growing institutional acceptance of alternative blockchains beyond Ethereum for financial applications. This development may accelerate the convergence of traditional and crypto markets.

Solana Price Target: Expert Predicts $180–$200 Breakout

Solana (SOL) surged 10.02% to $160.32 on Thursday, May 8, marking its highest level since March 3. The rally was fueled by rising DeFi activity, strong market sentiment, and network upgrades. Tracy Jin, COO of MEXC, suggests the momentum could propel SOL toward $200 if current levels hold.

Solana's decentralized exchange (DEX) ecosystem hit a milestone, with DeFi volumes surpassing $800 billion in 2025. While January accounted for over half of this activity, sustained interest in recent months underscores the network's growing appeal.

Will SOL Price Hit 200?

Technical and fundamental factors suggest SOL could challenge $200 if key conditions are met:

| Level | Significance |

|---|---|

| $179 (20MA) | Breakout confirmation |

| $202 (Upper BB) | Initial target |

| $200 (Psychological) | Liquidation cluster |

'The $180–$200 range is achievable if SOL holds $160 support and DeFi TVL growth continues,' says James. 'MACD reversal and institutional interest via Robinhood could accelerate momentum.'

60% chance of testing $200 by Q4 2025